Key Players: The IRDAI

Insurance Regulatory and Development Authority of India (IRDAI)

The IRDAI is the watchdog of India's insurance industry. It ensures fair play, transparency, and policyholder protection (just like what SEBI is to our investments & assets sector).

What are the key responsibilities of the IRDAI?

- Licensing and Supervision: IRDAI grants licenses to insurance companies and intermediaries (agents, brokers etc). It also supervises their activities to ensure their compliance with regulations.

- Insurance Product Approval: IRDAI also reviews and approves new insurance products designed by Insurance companies to ensure that they are fair, transparent, and financially sound. It also has the power to modify or reject products that do not meet its standards.

- Consumer Protection: IRDAI always cares about the consumer before the any other party. Which is why, it also provides a platform for filing complaints, investigates grievances, and takes action against insurers who violate regulations.

- Financial Solvency: IRDAI ensures that insurance companies have adequate capital to meet their obligations of paying out the claim to the customer.

- Investment Guidelines: IRDAI prescribes guidelines for the investment of insurance funds to ensure their that they are safe while being profitable.

- Claim Settlement: IRDAI issues guidelines for insurers to follow and provides a mechanism for policyholders to raise disputes to ensure that the claims process seamless.

- Market Development: IRDAI also promotes insurance awareness, facilitates the entry of new players, and supports innovation.

What are the challenges faced by the IRDAI?

- Low Insurance Penetration: Despite IRDAI's efforts, insurance penetration in India remains low at 4.2%, particularly in rural areas. This is mainly due to low awareness, complexity of products, and affordability issues.

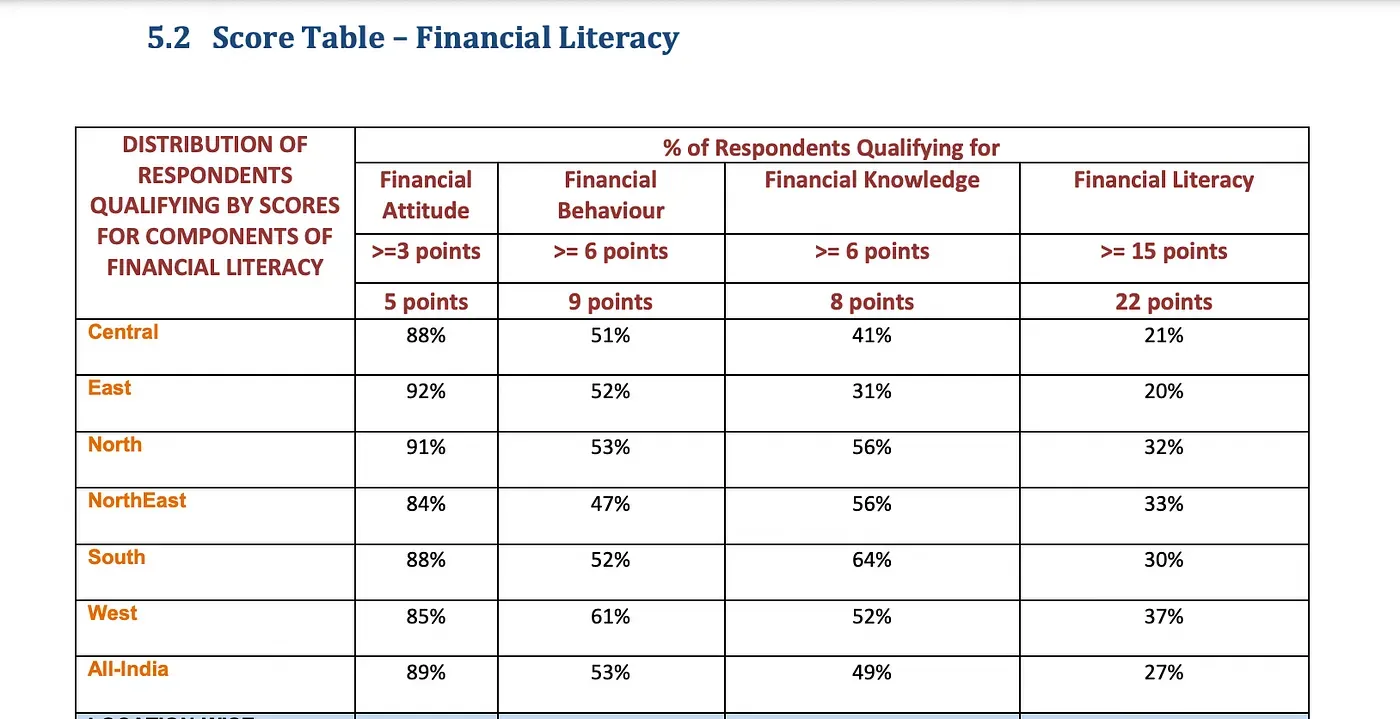

- Lack of Financial Literacy: A study by the National Council of Applied Economic Research (NCAER) found that only 27% of Indians have basic financial knowledge. This leads to poor decision-making, making it difficult for people to understand insurance concepts and benefits.

Financial Literacy.webp

- Complex Regulations: IRDAI's regulations can be complex, making it challenging for insurance companies to comply and for policyholders to understand their rights and obligations. This hinders innovation and increase operational costs for insurers.

- Emerging Technologies: IRDAI needs to adapt to the rapid pace of technological advancements and ensure that regulations keep pace with emerging trends. The lack of digital infrastructure, data privacy concerns, and resistance to change hinder digital transformation.

The insurance industry is constantly evolving, with new risks emerging such as climate change, cyber threats, and emerging technologies. The IRDAI needs to adapt its regulatory framework to address these challenges and ensure that insurance companies are prepared.

I really haven't dived too deep into IRDAI as I personally feel that having an in-depth understanding of IRDAI's working is not as important (for most people) as keeping up with the regulations and guidelines setup by the IRDAI. I'll be covering a few of them those in the relevant section in future articles.

I'll leave you with this. In the grand theatre of insurance, IRDAI isn't just writing the rulebook, it's also ensuring that everyone gets a fair chance to enjoy the show.

Let's Connect

Found this interesting? I'd love to hear your thoughts or discuss product ideas.